Supporting buyers in making confident home-buying decisions

Impact

Buyer readiness ↑ ~60%

Advisor clarification time ↓ ~20%

Deliverables

UX Design

Timeline

2 months

Team

Design manager

2 UX designers

UX research agency

TD is Canada’s second-largest bank and plays a critical role in helping millions of people transition from renting to homeownership every year.

Context

For first-time buyers, what should be an exciting time is often filled with uncertainty.

How much would I qualify for?

Does the house I like fit my budget?

Will this house fit my financial lifestyle over time?

These questions keep customers unsure and slow down conversions for the bank’s lending products.

The Challenge

Misaligned expectations that slow conversions

We wanted to hear from customer-facing staff to understand what buyers struggle with most commonly. Through a cross-functional workshop with 40+ domain experts, we learned

Buyers often enter the mortgage process with a fragmented understanding of their options. This information gap turns advisor meetings into basic clarification sessions, increasing the time-to-close and the risk of deal faliure.

The workshop highlighted 3 key problem areas

Existing tools didn’t answer buyers’ earliest questions

Misalignment formed weeks before buyers reached TD

Motivation peaks when buyers start browsing homes

Solution

We designed for the moment when buyers are most engaged, before confusion slows decisions and conversations

This early-stage experience helps first-time buyers understand whether a specific home fits their budget. It aligns buyers and advisors before their first meeting. Here's how it works.

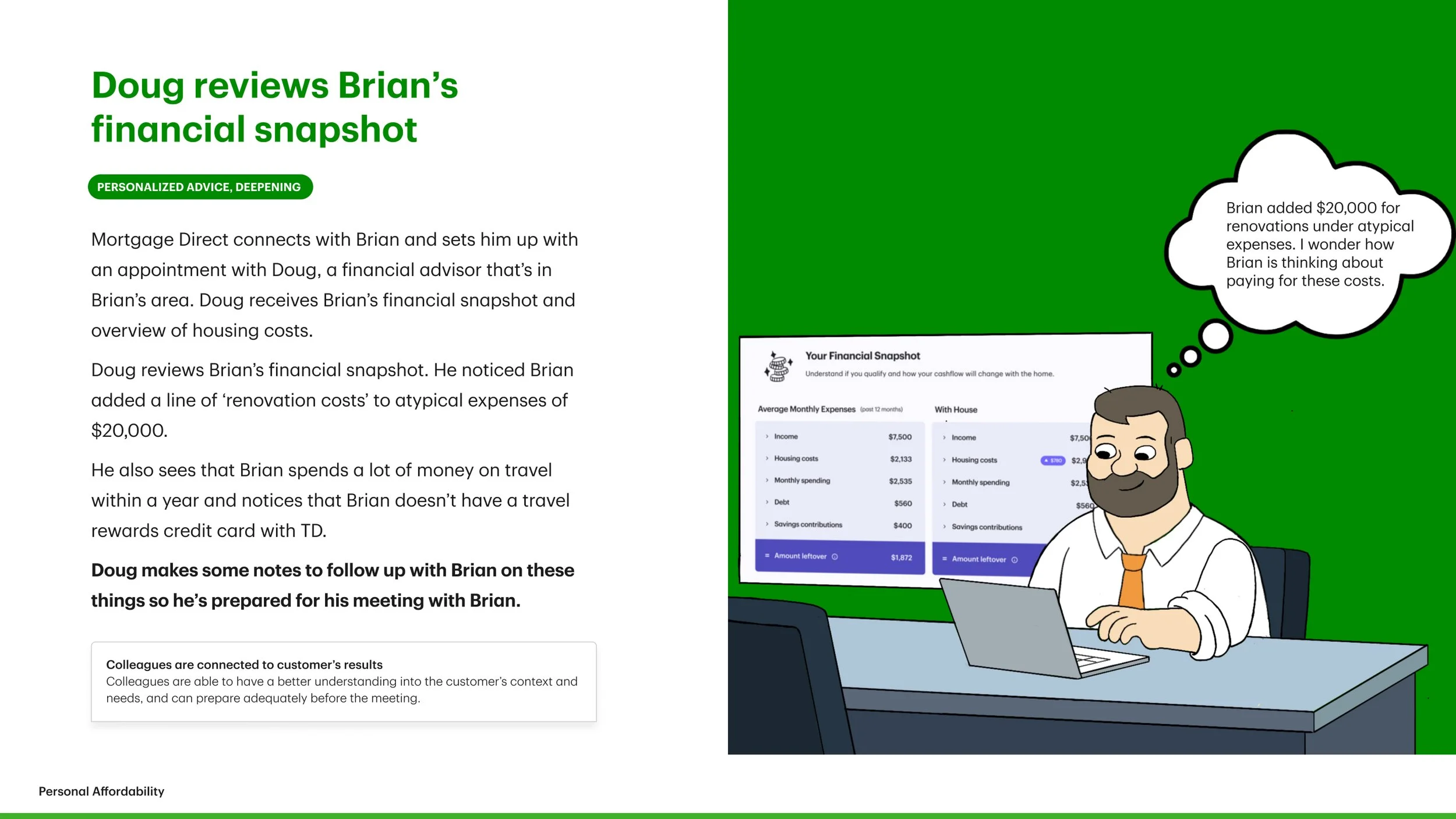

Through open banking, users connect their accounts or enter their financial details manually, and they can see how the house fits within their current financial habits.

As buyers come across a house they are interested in. They paste a link to the home and instantly see the costs they'd need to be prepared for.

Validting

Testing confirmed the experience improved buyer readiness and advisor efficiency

We worked iteratively and tested this tool with 40 first-time buyers.

Testing results showed 60% buyers feeling confident and ready to meet with an advisor.

Advisors also reported shorter, more focused conversations, spending less time correcting assumptions

and more time discussing next steps.

This validated our approach and showed a shift from reactive explanations to proactive decision-making

for both buyers and advisors.

Explored solutions

Exploration 1:

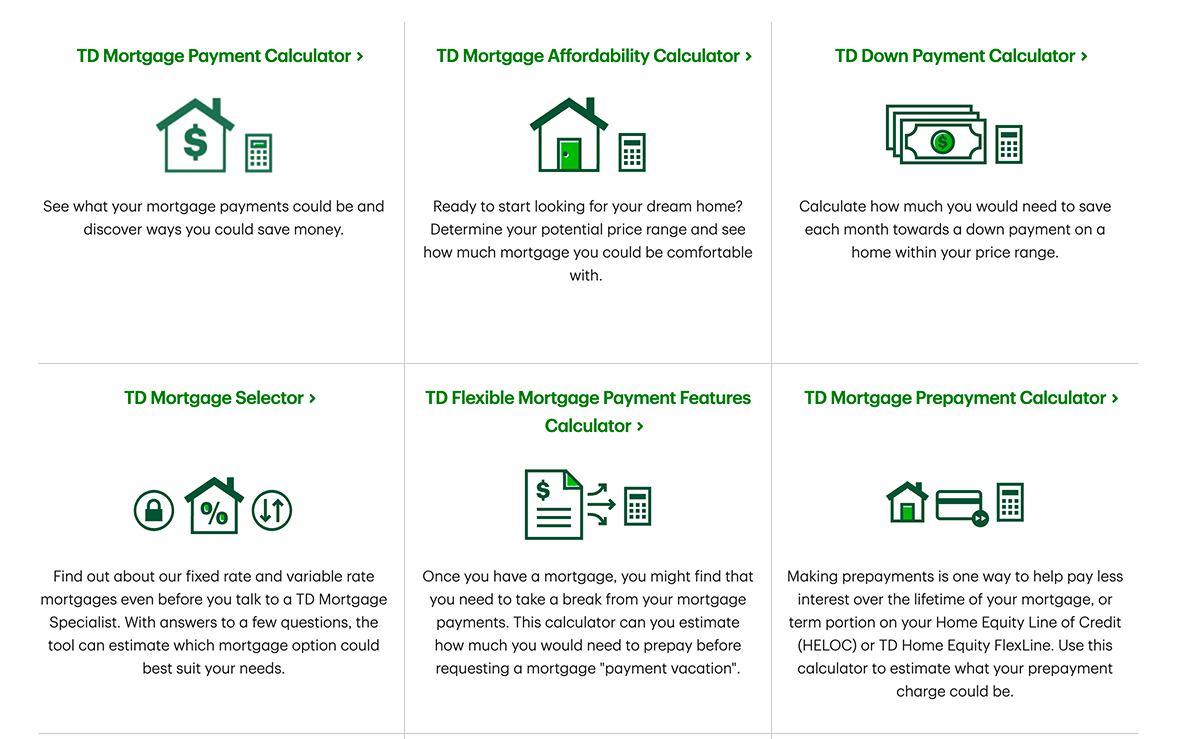

Review of existing TD tools

Existing TD calculators provided accurate calculations but did not support early affordability understanding or expectation-setting.

Exploration 2:

Advisor-generated affordability summary

We explored giving advisors a one-page affordability report that combined a buyer’s income, expenses, and estimated price range, and reviewing it together during meetings. While this made conversations more consistent, buyers still arrived without understanding what they could afford.

Exploration 3:

Pre-advisor affordability self-check

We explored a self-guided affordability check to help buyers assess readiness to speak with a bank. However, from our workshops, we knew buyers frequently relied on approximate financial inputs, leading to inconsistent understanding and continued misalignment during advisor conversations.

Reflection

Context and the timing of when it is given are key to making an experience feel natural and empowering. The key here was to step in at the right time before buyers get advice from people around them and search online.

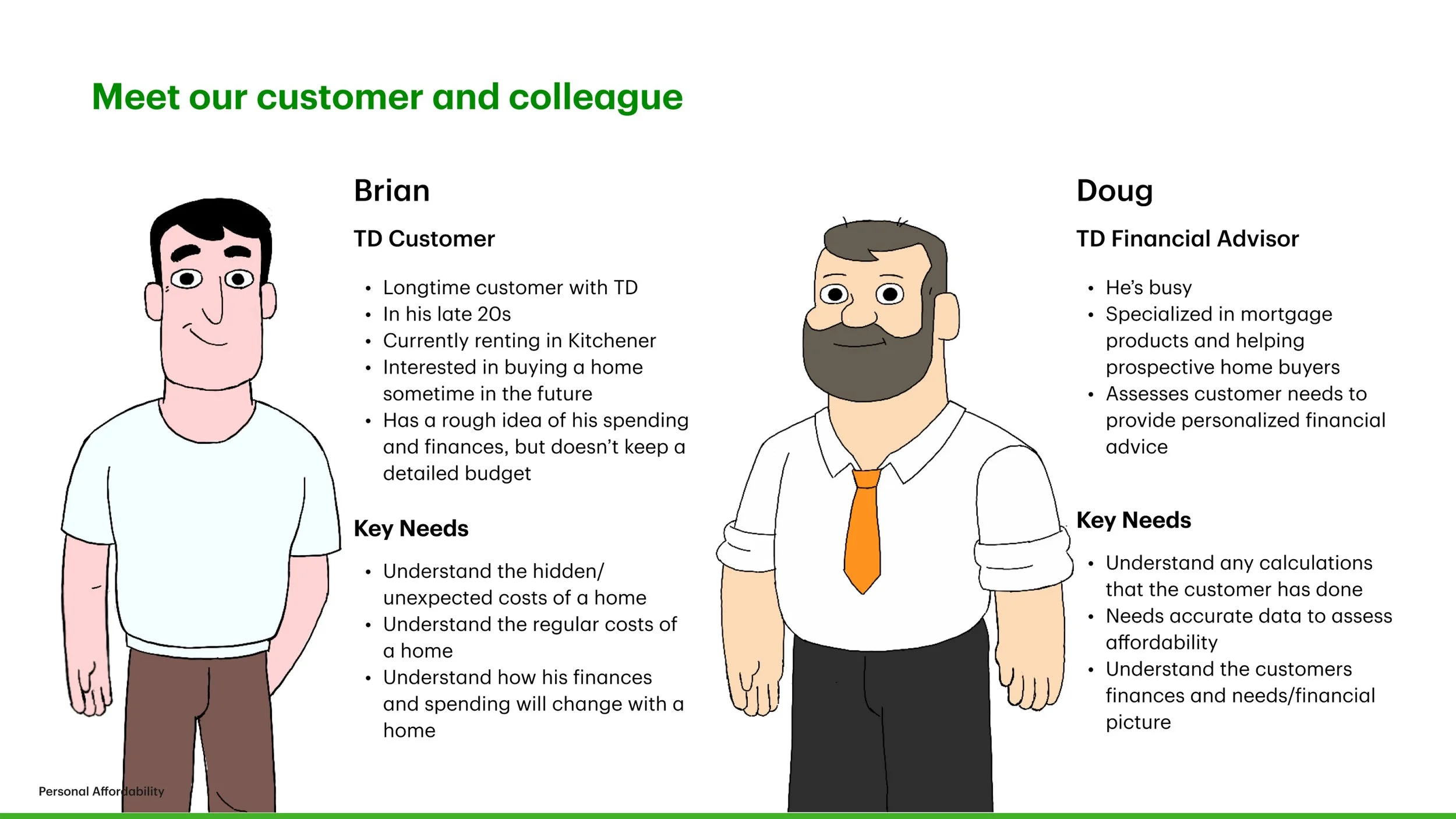

I made these illustrations clearly explaining both users and advisors would benifit from the product